Article Updated: 24 Dec 2022

- Introduction

- YouTube Tax: What should I do?

- Does YouTube Tax apply to AdSense earnings outside YouTube?

- Does YouTube estimated revenue report include U.S. tax deduction?

- I received a tax form 1042-S. What should I do? About Resident / Non-resident Aliens.

- Help Center / Resources / Links

YouTube Introduces Tax For Creators Outside United States

YouTube Creators / Google AdSense account owners are given a deadline:

- by May 31, 2021 YouTube creators / Google AdSense account owners should provide a valid tax information (tax forms will be renewed each year afterwards)

- from June 01, 2021 Google / YouTube will start collecting U.S. withholding tax* from all accounts if applicable

Recommended Reading

YouTube to run ads on all videos even if creator is not in YouTube Partner Program (YPP)

Here’s the original YouTube announcement from March 9, 2021:

Hi there,

We’re reaching out because Google will be required to deduct U.S. taxes from payments to creators outside of the U.S. later this year (as early as June 2021). Over the next few weeks, we’ll be asking you to submit your tax info in AdSense to determine the correct amount of taxes to deduct, if any apply. If your tax info isn’t provided by May 31, 2021, Google may be required to deduct up to 24% of your total earnings worldwide.

What do I need to do?

In the next few weeks you will receive an email to submit your tax information in AdSense. The online tax tool in AdSense is six steps and will ask you a series of questions to guide you through the process to determine if any U.S. taxes apply. For more information on these changes and a list of tax info to prepare, visit our Help Center.

Why is this happening?

Google has a responsibility under Chapter 3 of the U.S. Internal Revenue Code to collect tax info from all monetizing creators outside of the U.S. and deduct taxes in certain instances when they earn income from viewers in the U.S.

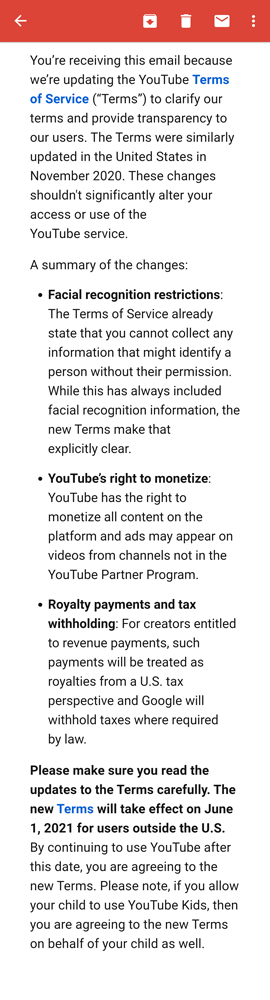

For creators outside of the U.S., we will soon be updating our Terms of Service where your earnings from YouTube will be considered royalties from a U.S. tax perspective. This may impact the way your earnings are taxed, and as required by U.S. law, Google will deduct taxes.

How will my earnings be impacted?

If you provide your tax info, U.S. taxes may only be applied to your monthly U.S. earnings from AdSense (revenue earned from viewers in the U.S. through ad views, YouTube Premium, Super Chat, Super Stickers, and Channel Memberships). If no tax info is provided, your tax rate will default to the higher individual backup withholding rate (24% of total earnings worldwide). To estimate the potential impact on your earnings follow these instructions.

Thanks,

The YouTube Team

In addition, TeamYouTube tweeted further explanation about what is going on:

@TeamYouTube via Twitter

“For creators outside of the U.S., we’ll be updating our TOS, where earning from YouTube will be considered royalties from a US tax perspective. This may impact the way earnings are taxed and as required by US law, Google will need to withhold taxes”

Update: And it’s official. Today’s email from YouTube about new Terms of Service update confirms global changes coming into effect on June 1, 2021:

Three years ago YouTube shocked creators with stricter rules regarding eligibility for channel / content monetization. Fast forward to 2021 and things do not appear to be settling down at all.

Economic wars between Google and European Union, France vs Google, and Australia vs Google are heated by global pandemic, COVID-19 outbreak and economic crisis.

Despite the fact that we live in a highly technological society and that vaccines were developed in record time by several countries independently, the cost is taking its tall wherever we look. In short, each country is requesting a piece of (your) cake, dear creator!

At this moment, it is not clear if this affair is Google’s or IRS’s (Internal Revenue Service) doing, which is controlled by Department of the Treasury and U.S. government / administration (in another words), shifting responsibility to collect taxes of any business activity on its own territory to companies themselves.

Before, your earnings from YouTube were classified as services, but from now on they will be treated as royalties (for example, like a music video or movie screening). Google is simply submitting to the laws in this case, but who initiated and provoked this change and why remains to be revealed. While we still have no definitive answer, it is most likely initiated by Google / YouTube itself.

Progressive tax rates are more advanced, and in many ways, offer larger degree of social justice. The more you earn – the more taxes you pay, to put it simply. But, in the eyes of the other (richer) side, that will always be unfair, because it is “not their fault” that you cannot earn more.

Some countries deploy fixed tax rates, and others (usually more developed ones) use progressive tax rates and more advanced financial systems. On the other end, there are countries which do not have any tax system established at all, because, like everything else, tax collection and enforcement requires huge financing as well, which is simply too expensive for them to manage.

YouTubers, vloggers, bloggers, website or app owners who run YouTube channel(s) earning majority of their income from an audience located in the United States (U.S.) will probably* experience a reduction in their revenue later this year. According to Chapter 3 of the U.S. Internal Revenue Code Google is required to collect tax info from all monetizing YouTube creators living outside United States and deduct taxes. This tax will be as high as 30% deducted from your total YouTube revenue.

* not true for some countries: UK, Canada, Ireland, Iceland, Denmark, Finland, France, Germany, Greece, Hungary, Japan, Norway, Slovenia, Switzerland and several other countries should not experience any change at all because of existing 0% U.S. Income Tax Treaties (avoiding double taxation). Many other countries have 5%-10%-15% tax relief rates, which will considerably reduce effective tax to manageable levels. Other countries which do not have tax treaty in effect with U.S. government will be impacted by the maximum amount of 30%.

disclaimer

information is provided as-is and we do not claim it to be 100% accurate. Please consult IRS Treaty Table (links provided below) and your local tax administration representative for clarification and actual values.

The upcoming change by Google is just a beginning of the end of low prices for goods and services on the mighty Internet. In decades years to come every country will likely introduce “internet” tax rates in one way or another, and many countries already do, as we can witness first hand.

For example, eBay services are already taxed in many countries, so whenever you sell something on the oldest trading internet platform, fees are increased automatically by the tax amount for specific country.

Popular stock photography sites have this practice implemented for years (royalties, remember?). In addition, many online earning platforms used by freelancers have automatic tax withholding practice, as well.

Amazon did something similar in the past few years, shifting its business operations for customers residing in Europe and updating its tax policy.

This change will effectively impact all english-based* YouTube channels, blogs and websites from individuals and companies, residing outside U.S. territory. Even if you’re part of MCN (Multi-Channel Network), you’ll be required to submit correct tax information. Of course, you can always opt-out and choose to ignore, but in that case you will be treated in less favorable way.

Needless to say, this affects AdSense users on a global scale, including blogs and websites earning revenue from U.S. based audience, further complicating their local tax submissions, forms and regulations.

Legal document this tax is based on is called Internal Revenue Code and it seems to be old almost a decade (last update was in 2014). However, it seems little contradictory to tax earnings by organizations and individuals who reside outside U.S. regardless from where their customers come from.

What if every country in the world makes a decision to take same actions? Imagine if you had to pay taxes for each country individually – your earnings would quickly evaporate, but more importantly, your tax management affairs will become a nightmare! These measures are effectively designed to limit money flow from one country to another via imposed taxes. Strange and interesting times are ahead, that’s for sure.

Is this fair? We can certainly argue about that. The issue is not in the tax itself, but the fact that this measure puts certain countries, and ultimately their users, in clear advantage over the others. But, such is the state of affairs in this world, there’s a lot of injustice and inequalities wherever you go, and this is not an exception. In the future, a global treaty between nations might fix this problem for good. Until then…

Google AdSense Tax Form: How much YouTube tax will I have to pay?

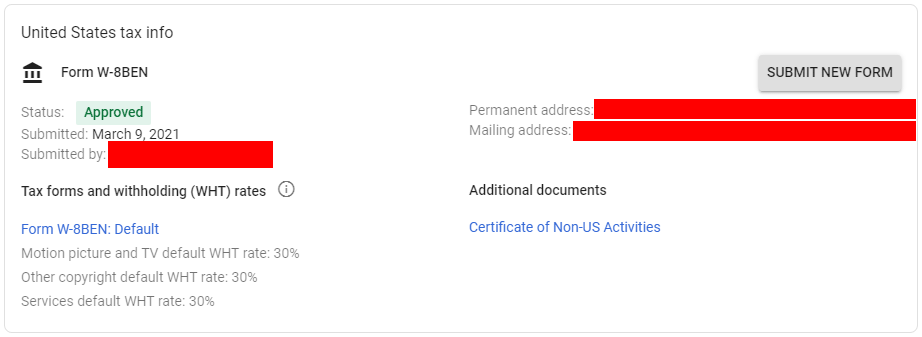

Once you sign-in and head over to your Google AdSense account, you will notice required tax info message both in an outlined rectangle box and under your notification bell icon. Once you click to fill-in required information, you will be presented with a complex W-8BEN (for individuals) or W-8ECI / W-8BEN-E (for legal entities / Businesses / Companies) forms that require some important personal or business information. In case of individuals, this is a lot of personal and legal information to submit. You will most likely require a lawyer, tax advisor or help from your respective government department to properly fill out all the data required.

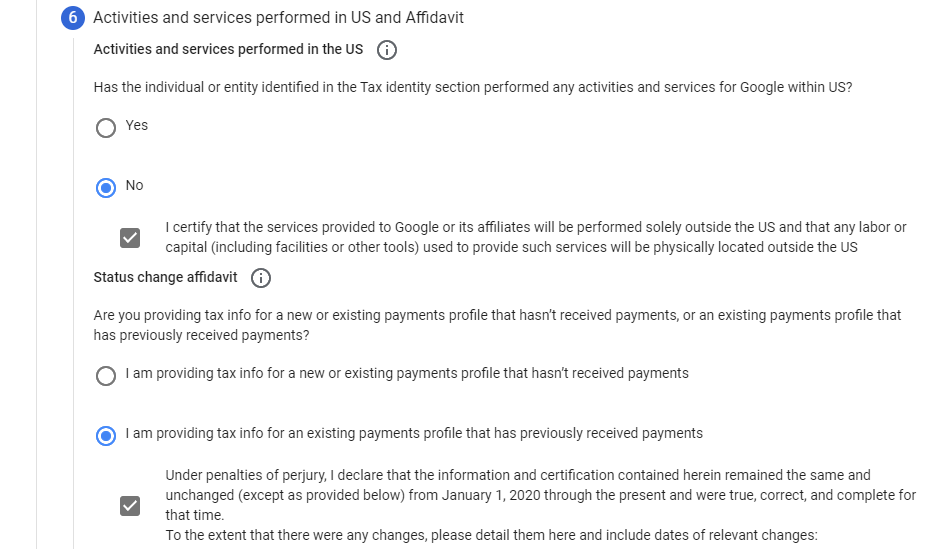

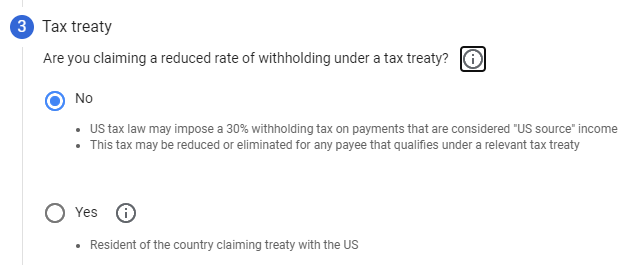

In the 3rd step of U.S. Tax Info form you will be presented with an option about existing tax treaty (see provided IRS link PDF document in last section below) between your country of residence and U.S. How much tax deduction will that provide depends on individual countries and regulations. If your country has a treaty, you must provide TIN number, which in case of individuals may simply be a unique social security number or alike (every country is different and you should consult your tax advisor with international experience).

Failure to provide proper information will default your account to generic 24% or 30% worldwide tax deduction rate!

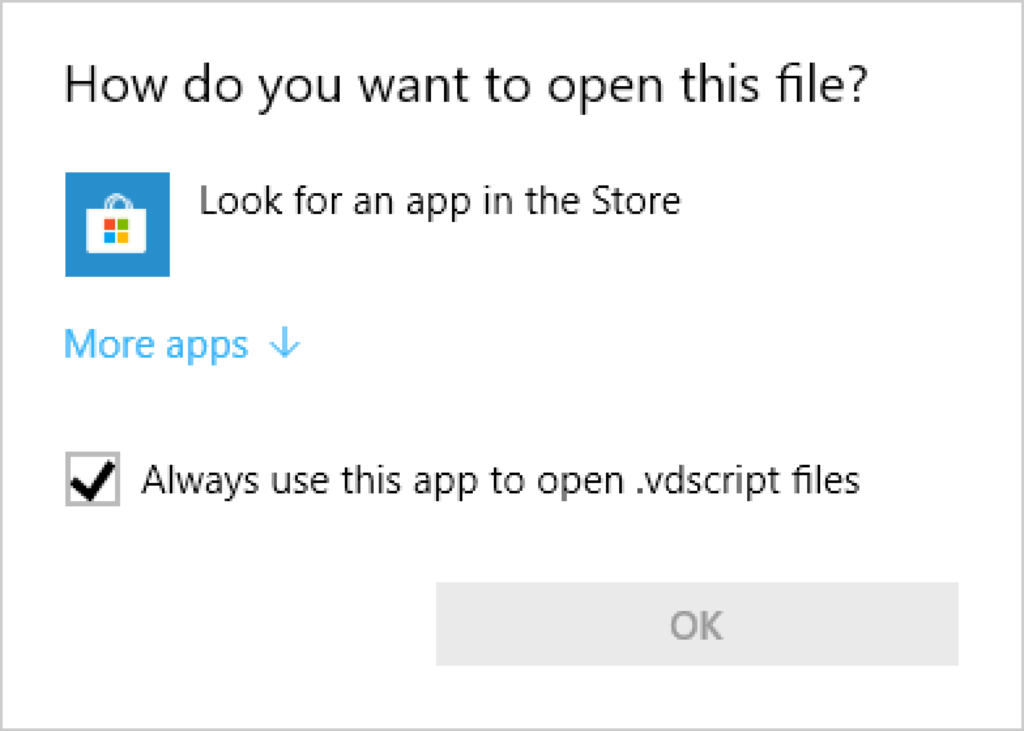

Google AdSense – U.S. Tax Info Form – Final Step #6

NOTE: selected options serve as an example / for demonstration purposes only!

However, even when you submit the tax information form, if your country does not have any special tax treaty with U.S., tax will remain at 30% rate for U.S. viewers. In the future, failure to submit U.S. Tax info form might even disable your AdSense account, although this remains yet to be seen.

Default U.S. tax form withholding (WHT) rates:

Motion picture and TV default WHT rate: 30%

Other copyright default WHT rate: 30%

Services default WHT rate: 30%

What is my TIN number?

TIN = Taxpayer Identification Number — not to be confused with VAT identification number used by companies or legal entities

TIN in UK = Unique Taxpayer Reference (UTR), National Insurance Number (NINO)

TIN in Canada = Social Insurance Number (SIN)

TIN in India = Permanent Account Number (PAN)

TIN in Indonesia = Nomor Pokok Wajib Pajak (NPWP)

TIN in Japan = Individual Number (“My Number”)

TIN in Korea = Business Registration Number (Google does not accept any other identification)

TIN in Russia = Taxpayer Personal Identification Number (INN)

TIN in Serbia = Jedinstveni Maticni Broj Gradjana (JMBG)

TIN in Australia = Tax File Number (TFN)

Tax Form Information Collection: Privacy Implications

Finally, all this brings us to the question of data privacy policy. Google will pass this information to IRS authorities, and they will be in possession of enormous amount of data about actual citizens and legal organizations from all over the world. Implications yet remain to be seen.

One thing is certain: the world we are living in is rapidly changing — for better or for worse.

YouTube Tax: What should I do?

You have 2 choices (options) at the moment — decision is entirely up to you.

YouTube U.S. WHT Tax: Choice #1

You decide to submit a proper tax form and pay up to 30% tax on your earnings from U.S. based viewers alone (this 30% value may go down to 0% for specific countries and tax-exempt entities). Earnings from other countries / regions will remain at the same level as before the change (excluding other factors like views change etc.).

Earnings / Revenue Example: Let’s suppose your country does not have any preferential tax treaties with U.S., which means you’ll be taxed by a considerable 30% rate. You earn $1000 each month total, out of which $500 comes from U.S. based viewers or visitors. This means that 0.30 x $500 = $150 will be deducted from your regular monthly income, and instead of $1000 you will receive only $850 as your finalized monthly earnings (effective reduction changes with U.S. viewership percentage).

YouTube U.S. WHT Tax: Choice #2

You decide to ignore this and do not submit any tax information. In this case, Google / YouTube will assume that you are a legal U.S. resident and your YouTube channel / AdSense account will be subjected to a 24% global (worldwide) tax if you are an individual (regardless of your country of residence) or 30% global (worldwide) tax in case of a business / legal entity registered / located outside U.S. or 24% global (worldwide) tax in case of a business / legal entity registered / located within U.S.

This is why it is important to submit your tax info form as soon as possible, to avoid extra tax deduction from your revenue when this law comes into force.

Earnings / Revenue Example: As in our previous example, you still earn $1000 monthly, but this time you did not submit any tax information form. Google will assume that you are a U.S. resident (from a legal perspective) and automatically tax all your YouTube earnings with a global / worldwide rate of 24% (assuming individual account). Instead of $1000 you will receive ($1000 – 0.24 x $1000) = $760 finalized monthly earnings.

If you are a U.S. resident living outside U.S. territory, your tax obligations might still be in effect. Call your tax advisor to clear any confusion regarding this matter and be sure you make the right choices while filling the Google YouTube AdSense tax form!

Does YouTube Tax apply to AdSense earnings outside YouTube?

AdSense earnings from Blogs / Websites / Android / iOS Apps and other non-YouTube products and services are not affected by this change (for the time being). In another words, you will continue to receive full amounts, as you did before.

According to Google answers source:

Question: Does this apply to my other AdSense earnings aside from YouTube?

Answer: No, under the condition that you provide valid tax info in your Google AdSense account, the U.S. withholding taxes under Chapter 3 should only apply to your YouTube earnings.

This is another valid reason to submit tax form and avoid extra expenses when this change comes into effect.

Does YouTube estimated revenue report include U.S. tax deduction?

Question: Are U.S. taxes already subtracted from “estimated revenue” reports in YouTube Studio?

Answer: No, according to our knowledge, they are not included in estimated revenue reports. Tax deductions under ch.3 are applied later, which you can check on your AdSense transactions page every month (or when you reach the payment treshold).

This means that whatever number you see in your estimated revenue is the amount you will receive after subtracting YouTube’s revenue share in case that your country of residence has preferential tax treaty with U.S. and tax amount is 0%. In all other cases that estimated sum will be subjected to taxation, according to the new terms.

I received a tax form 1042-S. What should I do?

You will receive a tax form 1042-S from Google if you are an “alien” citizen (foreigner) working and/or living within U.S. or if you just work for a U.S. based company but live in another country.

First of all, who or what is an alien?

There are 2 types of “aliens”:

(1) Resident Alien

If you’re a citizen of another country and you live and work in the United States, you may qualify as a resident alien. Resident aliens in U.S. owe taxes to the IRS on their entire income regardless where their money was earned.

(note: exceptions do apply, you might still be considered or treated as a nonresident alien, even if you meet below conditions!)

- Green Card winner who travels and lives in U.S. afterwards

- You own a working visa and contract with a U.S. based company (you spend more than 183 days* on U.S. ground during the 3 years period)

* terms and conditions apply to 183 limit:

(1) A minimum of 31 days during the current year

(2) All the days you were present in the current year

(3) 1/3 of the days you were present in the first year before the current year

(4) 1/6 of the days you were present in the second year before the current year

(2) Non-Resident Alien

Non-resident alien is someone who is legally in the U.S. for a brief period of time or who does not have a green card. Non-resident aliens are subject to taxes to the IRS on the income only from U.S. sources because they are already subjected to tax policy of their own country. Note that exceptions also apply here, depending on your country of origin, type of work, tax treaties, and so on.

- Let’s assume that you are a foreigner who legally works and lives in U.S., and you also happen to have a monetized YouTube channel, in this case, you will be considered as a nonresident alien from IRS and YouTube Tax withholding perspective.

(3) Not an Alien

Finally, if you are a citizen of another (non U.S.) country, and you live in another (non U.S.) country, but you work for a U.S. based company (which does not have a representative subsidiary in your country), then you do not have any alien status legally, but you may still be subjected to withholding tax (again, depends on your country of origin, type of work, tax treaties, and so on). This is exactly the case with Google’s YouTube platform now, because of the change from services to royalties classification last year (read introduction section above).

All right, now about that mysterious and confusing 1042-S form.

- If you live and work in U.S., regardless of your resident or non-resident alien status, you should probably file all required tax forms, just to be safe, even if you aren’t eligible for any tax return. That way you will notify IRS that withheld tax was already deduced from your income.

- If you do not live in U.S. and do not have any alien status (simply put, you only host a YouTube channel, but live in another country, and do not have a U.S. citizenship), then you probably do not need to file a 1042-S form on your own, unless you are eligible for tax return.

Employers must report wages exempt under a tax treaty paid to a nonresident alien on Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, and Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding.

and:

Who Must File 1042-S? Any withholding agent (a person or institution, such as an employer, university, or business) that paid any amount subject to withholding to a foreign person must submit a 1042-S. The 1042-S is filed with the IRS and a completed copy is also sent to the employee or business.

Essentially, Google (YouTube) already filed and paid a tax form on your behalf when it deduced it from your earnings, which is implied under your Google AdSense account (assuming that you properly submitted your W-8 form before).

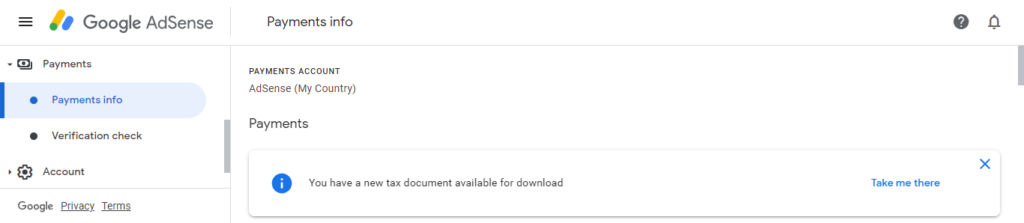

Google AdSense Home > Sidebar Menu > Google AdSense account > Payments > Payments info

(click on Take me there link)

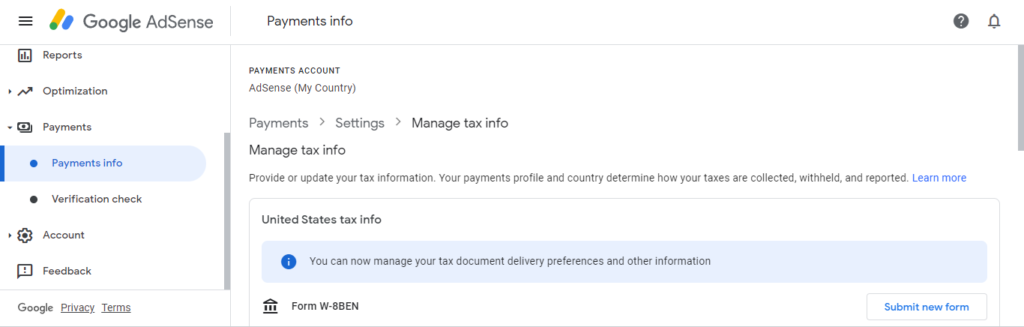

Payments > Settings > Manage tax info

Provide or update your tax information. Your payments profile and country determine how your taxes are collected, withheld, and reported.

Also, from this Google Help page under section Reporting:

Reporting

If you’ve received eligible payments from Google, we’ll provide a year-end tax form to you and the Internal Revenue Service (IRS). The form will be a 1099 or 1042-S depending on your tax status. The form delivery options and statuses for year-end tax forms can be found in Settings and then Manage tax info. You can choose online delivery of digital tax documents or select paper mail.

From above quote it is clear that Google has already submitted tax information about your payment and tax withholding to the IRS, and that received 1042-S form is for your reporting purposes.

Also, if you pay close attention to the received papers, you will notice that on first sheet of paper it says Copy B, and below the tax table it states: (keep for your records) notice.

Copy C and Copy D on second sheet of paper are used for tax return submission, if applicable. For example, if your country have special tax treaties with U.S., particularly those dealing with royalty income, and if you are eligible for tax return, you should definitely consider submitting this form either to the Federal department (Copy C) or State department (Copy D). You can do it using specialized online tax form submission services, such as FreeTaxUSA, CashAppTax, TurboTax… or you can do it manually by printing the tax return form offline (Google should already send you printed 1042-S copy by traditional mail service, unless you opted out for electronic email version only), fill it manually ✍️ (remember the pen? ✏️), and mail it using traditional post office service.

Wait, what happened to the Copy A? Copy A is filed with the IRS. As we already explained few paragraphs above this copy should already be submitted by Google/YouTube to the IRS prior to the actual payment to you.

There’s also a Copy E intended for withholding agent (which is Google/YouTube in this case).

*

Important fields in a 1042-S tax form are:

- Field 2 Gross Income – this contains a total amount of your earnings via YouTube

- Field 7a/7b/7c – this contains amount of withheld tax amount

- Field 10 – this contains a total amount of withheld tax (all fields 7+8+9 combined)

*

Download blank IRS 1042-S Tax Form (PDF) from IRS official website here >>

You will find all copies A, B, C, D and E in above PDF version, along additional pages with each field definitions and brief explanations. Once again, the form you receive from Google / YouTube should already be filled-in and submitted to IRS (Copy A).

Help Center / Resources / Links

- U.S. tax requirements for YouTube earnings

- Tax requirements for MCNs and affiliate channels

- Submitting your U.S. tax info to Google

- Check your AdSense account type

- U.S. IRS Income Tax Treaties A-Z

- U.S. IRS Income Tax Treaties Table (simplified table, not 100% complete according to IRS’s own words — read introduction, footnotes, and Royalties / Film & TV / Copyrights columns)

- U.S. IRS NRA Withholding – Withholding on Payments of U.S. Source Income to Foreign Persons Under IRC 1441 to 1443 (Form 1042) (Tax Forms 1441, 1442, 1443)

Watch YouTube Creators U.S. withholding tax introductory video:

![Xiaomi App - How To Re-Install Stock Factory Version - How To Fix Corrupted Gallery App [no root]](https://tehnoblog.org/wp-content/uploads/2025/09/Xiaomi-Gallery-App-Code-Bugs-Artwork-1024x576.png)

4 Comments

Add Your CommentHi guys, Canadian YouTuber here, I post vlogs and get a bit of Adsense money from them. That’s it.

For the W-8 BEN Treaty form, does anyone know if I should check off all 3 options:

Motion picture and TV Default WHT rate: 30%

Other copyright Default WHT rate: 30%

Services (AdSense): 30%

I claimed Services WHT rate: 0%, and that’s it. Not sure if I should check off all 3, or if the other 2 aren’t relevant to what I do?

Thanks!

March 10th, 2021J

Hi, on reddit one user posted a simplified table which states that the rate is 0% for Canada and that you need to input your SIN number in place for TIN when filling the form. However, there is also a disclaimer that that simplified table might be erroneous / wrong.

According to the IRS Treaty table (last link in our article above) on page 3, Film & TV is 10%, Know-How / Other Industry 0%, and Copyrights 0%. There are also footnotes below that table, which are important in some cases.

So, better check with your local tax representative to be certain, because opposite information appears on the net. We stated 0% in above article, because it should be in general, but don’t take it as 100% accurate!

March 10th, 2021For the comment above, if you don’t have a company – earn the revenue as a ‘self employed’ individual, in my understanding you need to select either:

– If you have general content, choose Motion picture and TV – choose the 10% (not the default 30%) because Canada has a treaty with the US – this is for Article XII paragraph 2 of the Tax Treaty

– If you have content related to culture, such as literature, music, picture, etc, choose Other copyright – 0% rate – this is for Article XII paragraph 3 of the Tax Treaty

The Services (AdSense) option is for businesses only – Tax Treaty Article VII

See the Canada-US treaty here: https://www.canada.ca/en/department-finance/programs/tax-policy/tax-treaties/country/united-states-america-convention-consolidated-1980-1983-1984-1995-1997.html

Don’t forget to select at the Point 6 that you work from outside US (answer No at the first question and check the case to certify).

March 18th, 2021Hi I live in Chile I have income from my youtube chanel. I received a forma 1042-S. My income is considered “effectively connected income” to the United States?

May 16th, 2022